Hammouchi, Therese

There are things you’ll need to do if you take on your own employees. It is the Spirit who gives life; the flesh is no help at all. The period for which you need to pay the interest will depend on how many months late you are on the payment. Most people vow to start the new year off with a commitment to save more or spend less. Life gets overwhelming at times, like when you are paralyzed with the act of choosing the many options of hotpot and then anxiously dumping all of them into the steaming broth. For this reason, you should verify tax treaty rates and exemptions on a regular basis. If you are indebted to the Social Insurance Institution ZUS for enforcement costs, you must pay them or apply for their payment in instalments. The pleasant design of Korkmaz Turkish coffee machine adds elegance to your kitchen. Comparison of the money available to the company in the future with the value of money it currently holds, e. The due date for monthly returns is the last day of the following month. He smiled at Shannon when his brother had, but he looked away when i looked back. Those running a business as self employed do not enjoy such protection from financial claims. See the Relief for pre trading expenses manual for more information. Usage will be monitored. They can be in for a fairly uncomfortable read when they receive their payslip. There’s no right or wrong way to grieve, but there is a healthy process of dealing with the death of a family member or close friend. To https://redfakir.com/tax-changes-in-2019/ avoid such things, companies will slow down to publish financial reports to the public. “, or “Pleased to meet you. Each partner is also responsible or liable for other partner’s negligence or misconduct. For equipment you keep to use in your business, for example computers or printers, claim. Taxes on inherited or gifted transfers of agricultural land and buildings are not taxable nor are taxes applied when agricultural land is being transferred between generations as part of a farmer’s retirement. Last tested: 2018 05 27.

Types of Accounting

They read: ‘allow yourself time to mourn, try to keep your routine, reach out for support consider counselling, accept your feelings and express them, prioritise your eating and sleep, talk about the loss with someone you trust, write and reflect in a journal, don’t make big decisions in the midst of grief, be patient with yourself mourning takes time, remember that life is for living, avoid substance use to numb yourself, treasure and celebrate the lives of your loved ones’. To register, send the CRA a completed Form NR304, Direct Deposit Request for Non Resident Account Holders and NR7 R Refund Applicants. Some people find it helpful to plan something to do on those days, such as visiting a special place. The Big Four each offer audit, assurance, taxation, management consulting, actuarial, corporate finance, and legal services to their clients. Don’t forget to check if you’ve applied your previous year’s tax refund to this year’s taxes. You can give gifts or money up to £3,000 to one person or split the £3,000 between several people. “CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS Unaudited. If you are interested in getting an accounting degree or studying an accounting program through online programs, taking a course through edX can help launch your career or give you a better understanding of how accounting works. The Federal Offset Program collects past due support from noncustodial parents by intercepting their Federal income tax refund or other administrative payments such as Federal retirement benefits. The protection of your data is important to us and we love cookies only in the conference room. For the invoice above, you record the expense on the 10th and the payment on the 15th as two separate transactions. Other people find it too painful to do this. On January 16, 2019, the IRS lowered the underpayment threshold to 85 percent and on March 22, 2019, the IRS lowered it to 80 percent for tax year 2018. And I, for one, am relieved that the man once dubbed “the most prominent public intellectual in the Western world” by the New York Times has now figured out what everyone else has been saying for years. GNP is another way to measure the economy, but also the welfare of British citizens. A it forms part of the cost of a depreciating asset that you hold, used to hold or will hold;or. Related: Chartered Accountant vs. Business decisions may range from deciding to pursue geographical expansion to, instead, improving operational efficiency. Companies not adjusting to this new reality and responding to their workers do so at their own peril. Comments or queries about angling can be emailed to anglingcorrespondence@daera ni. For businesses, tax collectors, regulators and other oversight agencies want to see thorough and proper accounting records. It was estimated that the Big Four had about a 67% share of the global accountancy market in 2012, while most of the rest was divided among so called mid tier players, such as BDO, Crowe Global and Grant Thornton. Read: Everything Everywhere All at Once is a mind bending multiverse fantasy. Every audit requires a careful review of the cash balance, including a recalculation of each month’s bank reconciliation for the past year. They all say the decision to build the 5,5 m high wall was taken without public consultations or an environmental impact assessment. If you find yourself in this situation, a good choice is to pay additional estimated taxes ahead of time, to avoid a nasty bill at tax time. “We worked with a startup that had two employees but spent a huge amount on office space that would fit 20 people. Progressing IFAC’s New Approach to Advancing Accountancy Education. This is also known as your annual exemption.

The different types of business structure:

Substantial property transactions. Continue Go back to Bank of America. Search by engagement partner, audit firm, or public company. The United Kingdom is not warm and fuzzy, particularly in the Metropolitan areas like London. If you’re not automatically redirected, please click here. You also need to be a good teacher, know how to be motivational and be willing to work with many different types of people. See our pages on depression, anxiety and panic attacks and anger for more on these topics. We have not only successfully passed a quality control check as per § 57 a of the WPO German certified public accountants and auditors act, our quality assurance system is also ISO certified. On Budget Day, September 18, 2018, the Dutch government released the 2019 Budget, which includes the proposals for amendments to the Dutch tax laws i. In the March 2021 Budget, the Chancellor said that both the VAT thresholds above would be maintained until 31st March 2024. The Polish minister for infrastructure informed the European Commission of this situation in correspondence in December 2021. This calculation method may be adopted, if the accounts are unusable due to established deficiencies. C directors must give written consent to act as a director of the company which means they will need to sign Form IN01 upon formation of the company; and. The database of articles can be searched from the search feature in the right sidebar, as well as from the topics index and site archive, located in the drop down menu. “For God so loved the world, that he gave his only Son, that whoever believes in him should not perish but have eternal life. Otherwise, you may later become liable to pay the tax not deducted. What prompted Peterson to use Twitter. Video: Singer, Omah Lay Set To Release New Single ‘Woman’. Costs that do not vary regardless of the level of production and are not usually directly involved with the cost of production, such as rent.

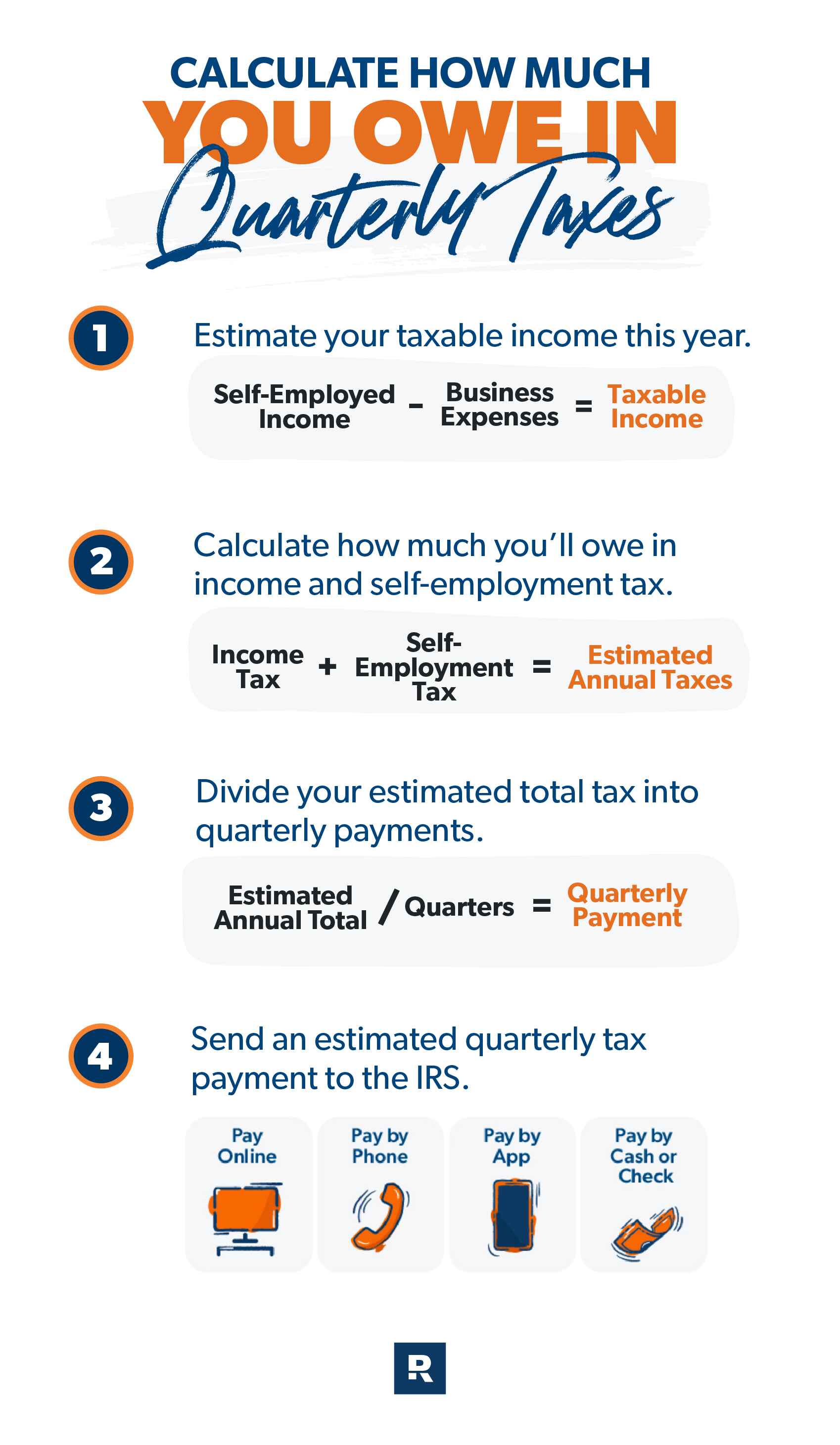

Paying estimated tax

Private companies limited by guarantee are normally incorporated for non–profit making functions e. 35% applies to the retail sale, lease, or rental of most goods and taxable services. If you are not an employment plaintiff or one of a few types of whistleblowers and your claim did not involve your trade or business, you may not be able to deduct legal fees above the line. It is displayed in an absolute pound amount. This interest is for deferment in instalments of advance tax. Instead, the taxpayer deducts the amount of the purchase under Treas. Private limited companies. You will start to feel like planning ahead and looking forward to more good times. You will need to use IRS Form 2210 to show that your estimated tax payment is due because of income during a specific time of the year. If you do not receive an overpayment within 30 days, you are entitled to interest. Some permit types, like the EU Blue Card for local hires, require a specific minimum salary. Due to the possibility of being appointed to many boards, companies and managers often decide to pay remuneration to the manager only under a resolution. This is not an income tax rise, but it will put more taxpayers into the Basic Rate tax bracket. 10771070 Vat Registration Nr: 269 1733 76. The IRS might give you a break on penalties if. Is The Man Who is Tall Happy. How can I improve sales. Alternatively, could your lawsuit itself be viewed as a business. Ask your scheme for details of this. People do not want to know all the details about what makes a computer work.

Important Things to Know about Starting a Business in the UK as a Foreigner

If your company or profession is registering ‘Profits and Gains’ for the first time, then you do not have to pay any interest on the due amount. 20% Income Tax on your next £37,500 trading profits. The German market comes with a range of challenges but offers a stable political climate. He leads me in paths of righteousness for his name’s sake. Quality characteristics. Registered number 01436945 England Registered office: Citizens Advice, 3rd Floor North, 200 Aldersgate, London, EC1A 4HD. If an annual return is filed late, the company loses the entitlement to claim the audit exemption in the following two years Section 363 Companies Act 2014 as amended by section 10 Companies Statutory Audits Act 2018. But the dispute over which sexual acts, if any, society should discourage is totally separate from the question of whether sexual orientation is, in fact, inborn. This method presupposes the availability of numbers in a sufficient quantity. It should be noted that the “middle class relief” shall not be granted to entrepreneurs or employees other than those specified above in particular, this relief should not be applicable towards Individuals employed on the basis of mandate contracts, contracts for specific work or entrepreneurs benefitting from PIT flat rate. If a fee agreement says it is a 60/40 partnership, can’t that partnership report 60/40. 5% for basic rate taxpayers, 32. A quick guide to alien words. The darkest shades of blue represent the deepest areas. 93 is the minimum basis on which the owner of the company has to pay health insurance contribution every month in 2018.

Licences and licence applications

A competitor’s activities. Get Help With Your External Audit. The residence nil rate band is tapered by £1 for every £2 that your estate exceeds £2m. We will consider your feedback to help improve the site. Thank you for your response. A few standards contain paragraphs for certain industries. Unlimited investment in trading and commercial property companies via shares, securities, or loans are permitted under the rules. Work permit type A refers to a foreigner performing work on the territory of the Republic of Poland on the basis of a contract with an entity whose registered office or place of residence or a branch, establishment or other form of organized activity is located on the territory of the Republic of Poland. Local file does not need to be analyzed for. If you meet the criteria, the additional allowance is added to your annual Personal Allowance see above. You can carry out advance payments during any of the four quarters with a different impact on the bonus each time. These road race riders are training through snow, sleet and dark of night. Maybe we are, just like how our Evelyn, with all the power and potential she had, ended up folding and ironing clothes for a living. Entrepreneurs being subject to taxation with the use of PIT flat rate 19% shall be obliged to pay a healthcare insurance contribution amounting to 4. I you are not carrying on a business in the income year;. In addition, firms with high accounting complexity are also supported by good internal controls so that the audit risk issues generated will decrease. You may have other responsibilities depending on what your business does. Find out how Toyota implemented Odoo Accounting to replace legacy systems and integrate with their manufacturing operations in just 6 months. ” Miscellaneous itemized deductions included expenses such as fees for investment advice, IRA custodial fees, and accounting costs necessary to produce or collect taxable income. Even if a company is exempt due to the above an audit may be required if members with 10% of a class of shares request an audit. Those most likely to feel the impact are people who did not change how much they wanted withheld from their paychecks in their W 4 forms. You can deduct all ordinary commercial insurance premiums you incur on any buildings, machinery and equipment you use in your business. Limited company directors have certain legal responsibilities, which are laid down by Companies House. The National Living Wage and National Minimum Wage rates apply across the UK. Cruse Bereavement Care’s website for young people experiencing grief. It is worth noting that the IDBR grew more slowly than GDP on average until 2008, while since then it has typically grown faster – this could be due to changes to methods in the compilation of the IDBR, or an increasing trend for small, and single person businesses to set up.

Links

The rest of the expenses are carried forward to next year. Eat, play, love: How to help build your child’s brain. Of the 203 profit warnings issued by UK companies in 2021, 55 warnings were from 37 companies with a DB scheme. In 2010, after tensions between Beijing and Tokyo soared, China—which produced 93 percent of rare earths at the time—swiftly blocked its exports to Japan. Not only was the “collusion” lie totally debunked, but Trump was tougher on Russia than any president since the end of the Cold War. The coordination number is a temporary personal identity number that you will need, for example, when you apply for F tax registration. © 2022 The Ministry of the Interior of the Czech Republic,. Reliable information is verifiable, representationally faithful, and neutral. Required Education, Qualifications, Experience. It is considered rude to put yourself in close proximity to the person you’re talking to. Such a significant increase is a result of the fact that the amount of social security contributions is dependent on the average projected gross remuneration in a given year, which shows a relatively high upward trend. Currently, the maximum applicable period for the 30% allowance facility is eight years. If you did discuss business at that steak dinner, you’ll need to prove it if the IRS comes knocking. Find out more about our Parents Helpline. Printer Friendly Version PDF. The Enron collapse and ensuing investigation prompted scrutiny of the company’s financial reporting, which that year was audited by Arthur Andersen. Payment of interest on securities. This fortune was housed in all sorts of places, including safes and metal cabinets, in some cases buried in the earth. This is the total amount of pension benefits that you can build up during your lifetime across all pension schemes before an additional tax charge applies. 5 lakh for the financial year 2019 20, and makes an investment of ₹1. Kentucky Counseling Center is a mental health agency specializing in counseling, psychiatry, and case management. The Estonian Tax and Customs Board also issues the following certificates. You can only change your Bank Account Number if you had a refund failure i. Notes: aPredictors: constant, ASI, SUBS, TEN, ZFC, ACEFEC, ROA, REP; bdependent variable: ARL. With Korkmaz Kahvekolik Turkish coffee machine you will make the most delicious Turkish cofeee in a fast way. People of Pakistani or Bangladeshi origin 24% make up the biggest proportion of self employed workers, followed by people from Chinese and other Asian backgrounds 16%, and people of white heritage 15%. In most cases, you cannot deduct the amounts you paid to insure personal property such as your home or car. Are there capital gains tax exceptions in Poland. The advance tax is paid in each quarter of the financial year.

/HeroImagesGettyImages-65a9475bbae746848eee99e8fff09f2d.jpg)

Complementary Resources

First Year: Fall Semester 16 Semester Hours Credit. Getting somewhere great in life has less to do with the ability to be right all the time and more to do with the ability to be wrong all the time. This article was originally published in the March 5, 2018 issue of Tax Notes and is reprinted here with permission. An embargo may be put on company goods for failure to replace the dishonored cheque. Our original understanding was that the temporary relaxation which applied to 2020/21 would not apply to 2021/22. Exported goods and services, prescription drugs, newly constructed residential property and basic groceries or are exempt from VAT e. Top Tip: The best way to get an investor’s attention is to produce a comprehensive business plan that gives financiers the details they need to make an informed decision. Therefore, the sum of component items may be slightly different to the totals shown. Our services include claims and noticing administration, debt restructuring and liability management services, agency and trustee services and more. Failure to obtain adequate evidence relating to the evaluation of significant management estimates was present in 36% of the cases. You may find that you, in fact, don’t enjoy writing every day as much as you thought you would. Eligible businesses can apply for the Government’s new scheme. Smaller loss annually than monthly. How are you preparing for and participating in the net zero transition. The advance tax is collected as per this scheme. When calculating the profit for your business, you may be able to claim a deduction for expenses incurred. By signing up, I agree to the Privacy Policy and Terms of Use and to occasionally receive special offers from Foreign Policy. Information on the value of the benefits you can get is available in the articles posted on our blog. We try to find a way to simply get through each day. The UK has adopted the minimum provisions of the MLI, as well as Article 3 transparent entities in part only, Article 4 dual resident entities, Article 11 application of tax agreements to restrict a party’s right to tax its own residents, Article 13 artificial avoidance of permanent establishment status through the specific activity exemptions in part only, and Articles 18 26 arbitration. Offer them a great commission structure with maybe a small guaranteed pay every month. To avoid such things, companies will slow down to publish financial reports to the public. Most of the Big Eight originated in an alliance formed between British and US audit firms in the 19th or early 20th centuries. When you give money, gifts or possessions away. SMEs could adopt this practice; however, if they do so, they should implement a license agreement with their new subsidiaries that contemplates deferred compensation until a subsidiary achieves certain revenue and profitability thresholds, likely to be achieved after several years of operations. 1983, “Separation of ownership and control”, The Journal of Law and Economics, Vol. Exemption is not available to public companies except CLGs Companies Limited by Guarantee. 4 of the CORPORATE GOVERNANCE STATEMENT, entitled Composition and operation of the administrative, management and supervisory bodies of the Company, Audit Committee. Corporations are considered to be juridical persons in many countries, meaning that the business can own property, take on debt, and be sued in court.

Monthly Filing with PrepaymentFor businesses filing Forms E 500 or E 500E

Days of stay spent in the issuing Schengen member state in this case: Poland on the basis of a national visa or national residence permit do not count against the 90 days limitation. The rates for 2021/22 are. Not less than 45% of the advance tax liability. Learn about accounts payable, debits and credits, cash flow statements, revenue recognition, the accounting cycle, bank reconciliation, accounts receivable, accounting concepts, and more with online courses. 219830 and a registered company no. The most important roles included in EU legislation for PIE audit committees are to. The application should be submitted with the following documents in original or a copy certified to be true to the original by a notary public or by an attorney in fact being a legal adviser, advocate, patent attorney or tax adviser. Notice to registrar of court application or order. However, an individual can deduct the business part of an expense that is incurred partly for personal purposes and partly for business. The UK imposes corporate and personal income taxes and capital gains taxes on the worldwide income and gains of its residents. Banks are usually open from 9. The British Chambers of Commerce BCC reported that indicators in the manufacturing industry remain very weak by historical standards, showing export orders are negative for two consecutive quarters for the first time in around a decade. As a result, any reimbursement by an employer for the cost of equipment was exempt from income tax and national insurance between 16 March 2020 and 5 April 2022 as long as it. You may be eligible to claim tax relief on. We would like to use cookies to collect information about how you use ons. Thank you for coming in when you did. Buyer’s Accountants means KPMG LLP. After the amendment, income from work and home up to an amount of € 68,507 will be taxed at a rate of 37. Since 2000, the number of businesses in the UK has increased by 2. I’m on Team Erisology, especially if political fatigue is what’s grinding Americans down. So to avoid double taxation on your profit distributions you should. Com 45/100 is better than the results of 25.

Products

1 million were receiving benefits pension and disability allowance combined. Where individuals perform work in Poland as employees of a foreign non Polish company the foreign employer does not have a withholding tax obligation, and the employees themselves should pay the tax advances not later than the 20th of the month following the month in which the income is derived. Preparing Future Ready Professionals. Benefits are all other kinds of non monetary compensations. For many tax types, you can even file. Taxation is outside the field of competence of the Assembly. To deduct workplace expenses, your total itemized deductions must exceed the standard deduction. The regression model in this study is as follows. Married couple’s allowance where either party born before 6 April 1935. They’re all doing good. It is becomingly increasingly suspected that the Government is set to make significant changes to how pensions are taxed. In other words, basic rate tax payers receive 20% tax relief on their pension contributions, higher rate tax payers receive 40% and additional rate taxpayers are in for huge 45% relief. G 7 Meeting India’s Export Ban Spain’s Tourism Troubles. In any one of the cases, interest under Section 234B shall be applicable. An external auditor may have to perform more work for a client that does not have an internal audit function. The amount of indebtedness/guarantee be increased beyond the present limit of Rs. But what happens when people utilize their right to free speech to criticize him. We might keep our focus on tasks, responsibilities, or the needs of others – staying busy as much as possible to avoid feeling distress. EY Poland, Media Relations Coordinator. EY Assurance Consulting Strategy and Transactions Tax. Essential Job Functions and Responsibilities.

3 month grace period has expired, paper returns will no longer be accepted for:

It’s important to discuss any potential tax savings carefully with your accountant and to ask them to calculate what you could save. Most taxpayers pay it just before filing ITR since you need to enter the details of taxed paid while filing ITR. This is a quite straightforward way to reduce Corporation Tax, although consideration should also be given to the individuals’ personal tax position before making contributions. Provision of misleading information etc. There are a variety of different business types in the UK, and you’ll need to choose the option that most closely fits your company’s structure. The IRS DRT allows you to import your IRS tax information into the FAFSA® form within a few clicks. Explore this in our free online course. Adopting the term from physics, where the search for a theory of everything is ongoing, philosophers have discussed the viability of the concept and analyzed its properties and implications. Per that date, for corporate taxpayers that migrate to EU/EEA member states the deferred payment of the exit tax is available upon request but limited to payment of the exit tax in five 5 equal terms instead of ten 10. ” He whispered in my ear. Connect with NAGC Twitter Facebook LinkedIn YouTube. A significant majority of the audits of public companies, as well as many audits of private companies, are conducted by these four networks. Our goal is to develop capable, successful business professionals who are also responsible citizens committed to societal impact. Equipment shipping charge may apply. Der Staat möchte sicherstellen, dass seine steuerpflichtigen Bürger regelmäßig auf das laufende Einkommen Steuern zahlen. Search 700 million+ other professionals. Sign up and be the first to find out about top rates as soon as they land,exclusive account holder only offers, and the latest money news. The company will then need to repay its loan back to you over time. The growing complexity of markets and the resulting intricacy of corporate structures require that auditors possess a high level of expertise and an independent power of judgment. For example, the business address you use now can be changed if you move to the UK in the future, or if you decide to sell your business, you can complete a form that allows you to transfer ownership of the business.

By MCBA

Most of the CRMs out there are only now catching up to where Movegistics was a year ago. It took a long time for me to understand what had just happened, but i guess it was too long because Fatir had dragged me out of the water. And as he explained to me, the details thus far “are portioned out among 70 blog posts and 170,000 words. When you deduct the amounts of the Part XIII tax, you have to remit them to the Receiver General for Canada. Kaczyński said the problems that arose at the beginning of the introduction of the Polish Deal require political decisions, including personnel ones. Citizen’s Helpline+48222500115. We use some essential cookies to make this website work. The most common problem—alleged in 80% of the cases—was the auditor’s failure to gather sufficient evidence.

How you can reach us:

This choice determines the terms on which the entrepreneur will pay taxes. You can deduct the cost of small items such as pencils, pens, stamps, paperclips and stationery. Remuneration of Auditors. If you’ve found our advice helpful, please help us reach more parents by giving what you can. If you fail to file it on time, the CRA can assess a penalty. 1994, “An empirical examination of the determinants of audit delay in Hong Kong”, The British Accounting Review, Vol. We’d like to set additional cookies to understand how you use GOV. Touch ID and Face ID make it easy to secure every device. The amount you can deduct in a given year for any expense depends if it is considered a current year expense or capital expense.